Chinese Tech Giants Urge Yuan Stablecoins to Challenge US Dollar Dominance

Chinese tech firms JD.com and Ant Group are urgently pushing Chinese regulators to allow yuan-backed stablecoins. Their goal: break the US dollar’s chokehold on global digital payments, as 99% of stablecoins are still dollar-linked. The two giants argue that the world needs a serious alternative in the form of a yuan stablecoin—starting in Hong Kong, with hopes to shape the future of cross-border money.

In This Article:

JD.com and Ant Group Lobby for Offshore Yuan Stablecoins

JD.com and Ant Group met privately with the People’s Bank of China to promote the idea of yuan stablecoins. They specifically want these coins to be backed by offshore yuan and issued in Hong Kong. Their argument: launching digital yuan stablecoins could help internationalize the Chinese currency and reduce the influence of US dollar coins, which currently dominate.

Why Tech Giants See Digital Yuan as Urgent: Dollar Still Dominates Global Payments

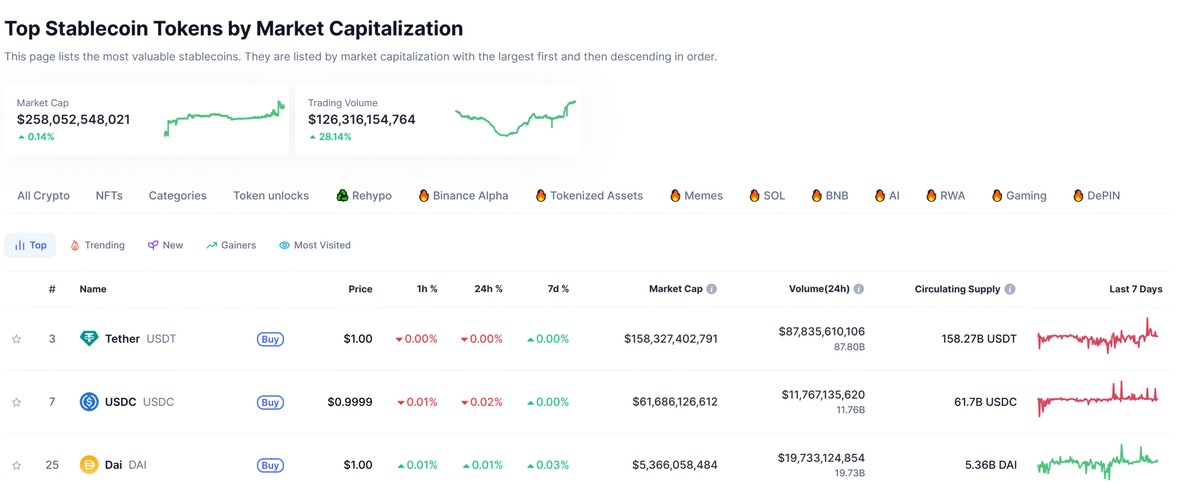

Right now, the yuan’s share in global payments has dropped to just 2.89%. By contrast, the US dollar controls a huge 48% share of the market. Today’s stablecoin market is worth $258 billion—and every one of the top 10 is dollar-denominated. JD.com and Ant fear that without a yuan stablecoin, China will fall further behind, both in digital payments and international trade.

Hong Kong and Singapore Set the Stage for Stablecoin Innovation

JD.com and Ant Group are preparing to apply for stablecoin licenses in Hong Kong and Singapore, with plans to launch not just yuan-pegged coins, but also a Hong Kong dollar stablecoin by the year’s end. Hong Kong just announced new rules for stablecoin companies—clear regulations designed to grow local tech, boost adoption, and attract global talent to the region.

The Future: Multipolar Currency System and Global Stablecoin Race

China’s central bank says it wants to see a “multipolar” currency world—not one just ruled by the US dollar and euro. JD.com’s founder revealed plans to apply for stablecoin licenses globally, while Ant Group is expanding across Asia and Europe. But for now, non-dollar stablecoins like euro-backed EURC still only scratch the surface, trailing far behind the dominance of dollar coins.